It tries to indicate that buyers have regained control after sellers pushed the price down, reflecting a shift from a downtrend to an uptrend. This pattern tries to provide traders with insights into market sentiment and potential entry points for potential trades. A Hammer pattern is a single candlestick formation that often signals potential trend reversals within the forex market. As you can see in the EUR/USD 1H chart above, the RSI helps us in identifying a trend reversal.

The following aspects will help you in trading with the inverted hammer candlestick pattern. An inverted hammer in a downtrend suggests a shift in market sentiment from bearish to bullish. It indicates a potential shift from a downtrend to an uptrend in the market. While it may seem counterintuitive due to its name, the setup suggests that buying difference between hammer and inverted hammer pressure has overcome selling pressure and that bulls are gaining strength. The bullish engulfing pattern and the ascending triangle pattern are considered among the most favorable candlestick patterns. As with other forms of technical analysis, it is important to look for bullish confirmation and understand that there are no guaranteed results.

What Is The Difference Between Hammer And Inverted Hammer?

It shows that the price is ready to decline after a strong uptrend as the candlestick has a long lower shadow that depicts the force of bears. The setup is almost the same as both of these patterns are bullish reversal formations. It is actually almost the same chart, it’s just that this sequence occurred a bit later.

- The Inverted Hammer Candle, therefore, represents a battle that leads to downside price exhaustion and a potential buy point, signaling the beginning of a bullish trend.

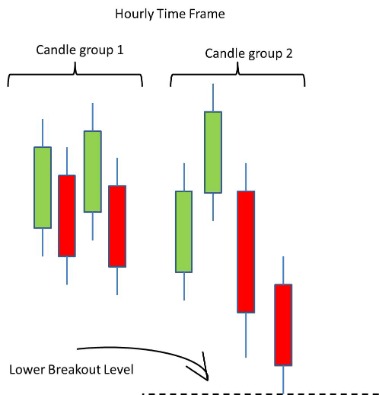

- Traders look for subsequent candles to validate the anticipated reversal direction, trying to ensure a comprehensive approach to decision-making.

- I would encourage you to develop your own thesis based on observations that you make in the markets.

- Entering the market after the second candlestick provides a higher risk/reward ratio, where the risk can exceed the ratio dramatically.

It means for every $100 you risk on a trade with the Inverted Hammer pattern you make $18.2 on average. No detection – the indicator does not take price trend into account. The only difference between them is whether you’re in a downtrend or uptrend.

Dual Momentum Trading Strategy (Gary Antonacci)

When a hammer appears, it is indicating that the market is trying to seek a bottom. Hammers suggest a probable surrender by sellers to create a bottom, which is accompanied by a price increase, indicating a possible price direction reversal. This occurs all at once, with the price falling after the open but regrouping to close around the open. This battle is depicted by the long lower shadow and the small body of the candle.

A bullish belt hold is a pattern of declining prices, followed by a trading period of significant gains. In technical analysis, this is considered a sign of reversal after a downtrend. As with other forms of technical analysis, traders should be careful to wait for bullish confirmation. Even with confirmation, there is no guarantee that a pattern will play out. Read on to learn more about one of the most significant candlestick patterns in trading – the inverted hammer candlestick pattern. A hammer candlestick is a type of bullish reversal candlestick having one candle in price charts of financial assets.

Ways Pros Use Trading Indicators: Proven by Data

In the world of forex trading, mastering the art of interpreting candlestick patterns is essential for making informed trading decisions. The Hammer and Inverted Hammer are two candlestick patterns that might appear similar at first glance, yet they hold distinct implications for traders. Although in isolation, the Shooting Star formation looks exactly like the Inverted Hammer, their placement in time is quite different.

GBP/USD Weekly Forecast – British Pound Gives Up Early Gains for the Week – Yahoo Finance

GBP/USD Weekly Forecast – British Pound Gives Up Early Gains for the Week.

Posted: Fri, 01 Sep 2023 17:02:24 GMT [source]

An inverted hammer forms when bullish traders gain confidence, and the open, low, and close prices are almost the same. The bullish traders create the long upper shadow as they take over and push prices as high as they can. On the other hand, bears or short sellers https://g-markets.net/ form the tiny lower small wick as they oppose the rising prices and try to push them where they were during the open. However, with an inverted hammer actually materializing, the buying pressure overpowers the bears, and the price settles at a higher level.

How do you trade an inverted hammer?

This is a major difference to the previous state of the market, where sellers dominated the scene. The increased confidence of the buyers becomes the end for the downtrend, and a bullish trend emerges shortly thereafter. The Inverted Hammer formation is created when the open, low, and close are roughly the same price.

Pairs in Focus This Week – GBP/USD, EUR/USD, USD/JPY, GBP … – DailyForex.com

Pairs in Focus This Week – GBP/USD, EUR/USD, USD/JPY, GBP ….

Posted: Sat, 09 Sep 2023 15:15:20 GMT [source]

While a hammer candlestick pattern signals a bullish reversal, a shooting star pattern indicates a bearish price trend. Shooting star patterns occur after a stock uptrend, illustrating an upper shadow. Essentially the opposite of a hammer candlestick, the shooting star rises after opening but closes roughly at the same level of the trading period.

Investors should use candlestick charts like any other technical analysis tool (i.e., to study the psychology of market participants in the context of stock trading). They provide an extra layer of analysis on top of the fundamental analysis that forms the basis for trading decisions. This pattern yields a hammer-shaped candlestick with a bottom shadow at least twice the size of the actual body. The difference between the open and closing prices is represented by the body of the candlestick, while the high and low prices for the time are represented by the shadow. However, as the market opens the next day, the bears have started to doubt that the market is headed much lower. For the rest of the day, sellers and buyers remain equally strong, and the market closes around the same level it opened.

- Traders believe the market could soon reverse from a downtrend to an uptrend.

- While a bearish inverted hammer forms when closing and lower levels are near equal.

- The TC2000 dragonfly doji candlestick scan is a rare formation often interpreted as an early warning that recent trend direction is about to shift higher.

- However, the buyers eventually step in, and the price rallies, driving the price above the low.

Pay attention to the bottom-most candlestick forming an inverted hammer. After a significant previous-day fall, the stock opened below and closed slightly higher than its opening price, forming the inverted hammer pattern. A bullish inverted hammer forms when the opening and lower prices are nearly equal.