It can be daunting to start trading with CFDs as a total beginner, however, with a supportive broker and the right mindset, it is possible to make money. This is why it is important that British traders sign up with a brokerage regulated by the Financial Conduct Authority (FCA). This will provide new traders with several benefits, from negative balance protection and segregated client accounts cfd trading for beginners to a ban on misleading promotions and a cap on trading leverage. This will let you practice trading CFDs with virtual funds and gives you the opportunity to find a strategy that works, without risking your own money. You can then upgrade to a real-money account when you feel confident. If you are an investor looking to make good returns on your money, then CFD trading is a good choice.

- Leverage risks expose you to greater potential profits but also greater potential losses.

- Then you can choose which one you prefer the most and open a live account.

- 77% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Fortunately, with a wealth of useful ‘CFD trading for beginners’ PDFs, books and educational material available, anyone can learn the fundamentals and get started. Contracts for difference, also known as CFDs, allow investors to speculate on the price of financial markets without taking ownership of the underlying asset. CFDs are also usually traded with leverage, meaning clients can increase their position size (and potential profits), in return for a small deposit. Independent Investor is a news and educational portal covering latest events in the world of trading and investment. Between 74-89% of retail investor accounts lose money when trading CFDs, forex, and spread betting. You should consider whether you can afford to take the high risk of losing your money.

Every day, securities are traded on the financial markets across the globe. The buying and selling of securities on these markets cause price fluctuations that move the prices of these securities up and down. The development of CFD trading has been significantly influenced by technological improvement. Investors can easily access their trading accounts from any location at any time thanks to online trading platforms and mobile applications. In order to take advantage of market opportunities, traders now have access to real-time price updates, sophisticated charting tools, and algorithmic trading skills that are already standard.

Part of the reason why CFDs are illegal in the U.S. is that they are an over-the-counter (OTC) product, which means that they don’t pass through regulated exchanges. Using leverage also allows for the possibility of larger losses and is a concern for regulators. Brokers currently offer stock, index, treasury, currency, sector, and commodity CFDs. This enables speculators interested in diverse financial vehicles to trade CFDs as an alternative to exchanges. The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested.

How To Start CFD Trading

Trading CFDs means trading contracts that have been issued by your CFD provider backed by an underlying asset. CFDs involve less capital to start than stock purchases because they are traded on margin. For example, if you think the bitcoin price will rise in future times, then you buy 50 bitcoin contracts at the buy price of 7500. To understand the profit and loss in CFD trading, you will know how you can make money from it.

So, while traditional markets expose the trader to fees, regulations, commissions, and higher capital requirements, CFDs trim traders’ profits through spread costs. The main advantages of CFDs include access to high leverage, low entry barriers, short-selling, and around-the-clock access to the financial markets. Major drawbacks include trading costs (spreads), margin requirements, and financing costs in case a trader uses leverage in his or her trading. They allow traders to speculate and trade on various instruments across different asset classes.

For instance, the Australian 200 Index might have a margin requirement of 1%. If the value of the ASX 200 is 7,000, you would need to have $70 on your account. Trading CFDs allows you to make a profit or loss when you speculate on the price movement of a financial asset. One of the most important things to do before opening any positions is to research the market and confirm your predictions with technical and fundamental analysis. Also make sure you utilise stop-loss and take-profit orders to protect potential profits and limit any losses.

He specializes in writing about the US markets and has developed a keen interest in cryptocurrencies and decentralized finance. This means CFD traders are not able to express their opinions on any major company issues. Although the leverage and reduced fees/taxes are attractive, there are some significant disadvantages to trading CFDs.

With investing, you’d be selling your shares for $50 less than you paid for them. With CFD trading, you’d still exchange the difference in Tesla’s price – but because the market has moved against you, you pay your provider $50 per share. And that contract enables you to exchange the difference in an asset’s price from when you open your position to when you close it. Leverage risks expose you to greater potential profits but also greater potential losses. While stop-loss limits are available from many CFD providers, they can’t guarantee that you won’t suffer losses, especially if there’s a market closure or a sharp price movement. Essentially, investors can use CFDs to make bets about whether or not the price of the underlying asset or security will rise or fall.

Her profit on this trade (less spread costs and overnight financing) would be $600. John was correct in his thinking that BOQ would fall in value and decides to close the trade. He closes the trade at $9.40 and makes a $3,000 profit (before overnight financing charges and commission charges).

Admiral Markets

The cost of the transaction is $2,526 (plus any commission and fees). This trade requires at least $1,263 in free cash at a traditional broker in a 50% margin account, while a CFD broker requires just a 5% margin, or $126.30. As a result, traders should be aware of the significant risks when trading CFDs. To buy, a trader must pay the ask price, and to sell or short, the trader must pay the bid price.

So, find out everything you need to know in my complete guide to CFD trading for beginners. It is recommended that traders focus on one asset class when they are beginning to trade with CFDs rather than spreading themselves thin trying to master everything at once. Interactive Brokers is designed for both experienced and inexperienced traders and has access to almost any trading tool you can imagine.

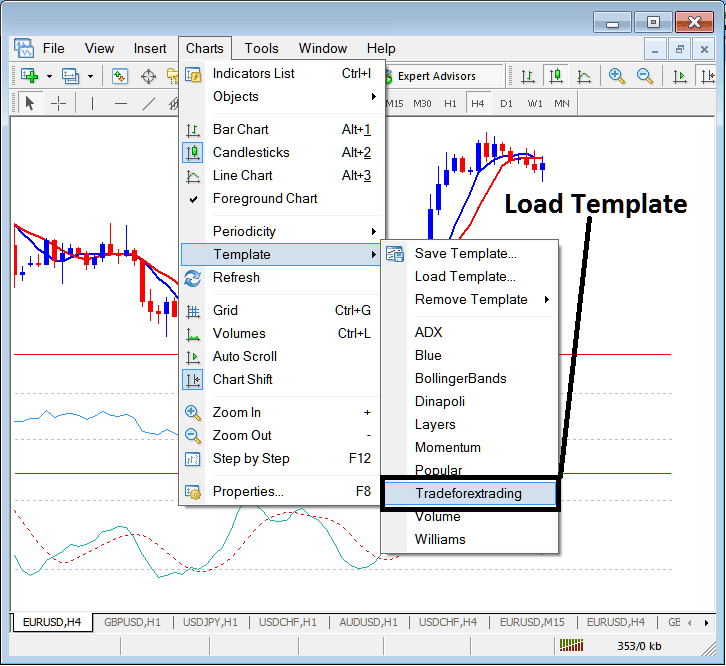

Remember that if the price moves against you, it is possible to lose more than your initial position margin of £800. One of the most important things you should consider when looking to start trading CFDs is the trading platform you are going to use. The key difference between CFD trading and share trading is ownership. You gain voting rights and the right to any dividend the company pays out.

Some of the most popular platforms in the UK offer CFD trading, including eToro and IG. Firstly, you need to open an account with a CFD broker that offers CFD trades. In this example, rather than using your £1,000 to buy the 100 shares in company X, your broker asks for a percentage of the trade instead. So, for example, if you had £1,000 to invest, you might buy 100 shares at £10 each in company X, assuming there are no account or commission fees.

How do I trade CFDs?

They are margin traded, highly leveraged instruments that are generally (although not exclusively) sold off-exchange across a range of different markets. They can be a fantastic way to capitalise on incremental market movements, but also an extremely dangerous tool for any investor. But getting down to the finer detail is what’s key to truly understanding CFDs – knowledge which can then be interpreted to make profitable trading decisions.

However, a lot of things have changed in the 21st century, making stock buying & much more accessible to a “regular” citizen. In other words, you do not need to have millions of dollars in your bank account to make a transaction in this industry. With easy access to the Internet and Contracts for Difference or CFD, it is not easier than ever to trade.

Each broker will often use different leverage amounts, and these will also vary from market to market. However, being able to use leverage will allow you to invest with far less capital. With CFD’s trading, you also can access leverage with your trading position. ‘Going long’ is when you open a BUY trade in the hope that a financial asset will increase in value. Most notably that brokers will be closely monitored by the countries’ governing regulator. Tier-one require that all brokers work within a strict framework, ensuring a business is run in accordance with local laws and regulations.

It’s not a question of one being better than the other, as both CFD trading and investing have their advantages and disadvantages. CFD trading offers more flexibility and potential for higher returns, but it also involves higher risk and requires more active management. Investing, on the other hand, is typically a long-term strategy that offers more stability and lower risk, but with potentially lower returns. Successful traders won’t open a position without attaching a stop – no matter how experienced they are.

BTI: Split chances between reaching the resistance level of $35, or falling to a new 52W low – FXStreet

BTI: Split chances between reaching the resistance level of $35, or falling to a new 52W low.

Posted: Mon, 15 May 2023 12:45:18 GMT [source]

When you buy CFDs with leverage you only need to pay a percentage of the full price of an asset, called the margin, and your broker will lend you the rest. You can also trade other instruments with leverage but CFDs offer particularly low margins. CFDs have no expiration date, so positions can be held for extended periods.

Investors less sure about influence on Fed [Video] – FXStreet

Investors less sure about influence on Fed .

Posted: Mon, 15 May 2023 05:47:15 GMT [source]

When you start CFD (contracts for difference) trading as a beginner, you should first understand the basics of trading CFDs. View our CFD examples and consider opening our CFD demo account, where you can practise trading in a risk-free environment. When you start CFD (contracts for difference) trading as a beginner, you should first understand the basics of trading CFDs. Unfortunately, your prediction was wrong and the price of ABC plc drops over the next hour to a sell/buy price of 1,549/1,550.

Because the industry is not regulated and there are significant risks involved, CFDs are banned in the U.S. by the Securities and Exchange Commission https://trading-market.org/ (SEC). The U.S. Securities and Exchange Commission (SEC) has restricted the trading of CFDs in the U.S., but nonresidents can trade using them.